The Impact of Interest Rates on Closed Sales and Prices

This article aims to provide a comprehensive understanding of the current state of the Playa Vista real estate market, future trends, and the intricate balance between supply and demand.

A Closer Look at Market Dynamics: Playa Vista in Focus

For those who already own property in Playa Vista and prospective buyers exploring the market, staying updated on trends is imperative. But how can we differentiate between short-lived fluctuations and significant shifts? Here, we spotlight the Trailing Twelve Months (TTM) metric as a key instrument.

The TTM metric serves as a cornerstone for Playa Vista real estate, given the limited number of closed sales each month. Through this metric, we gain clarity on the market’s performance and insights into its potential direction.

Playa Vista Market Trends – Trailing Twelve Months (TTM)

Dwindling Closed Sales

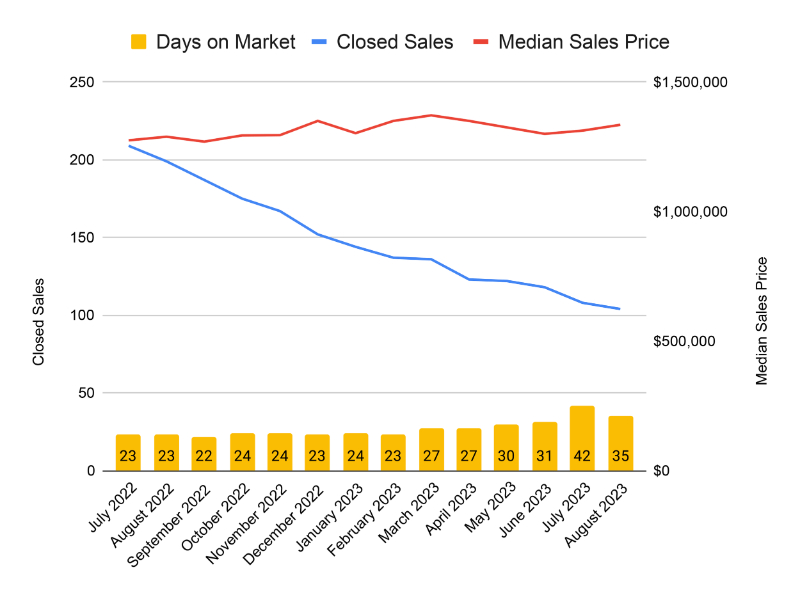

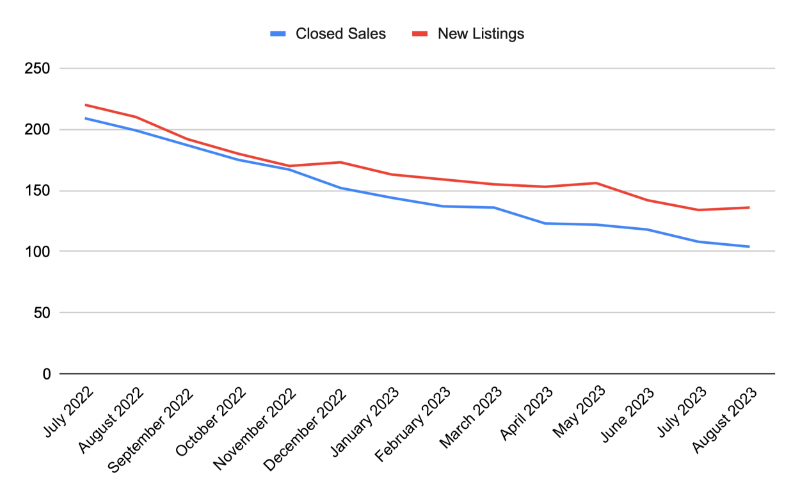

One clear trend is the consistent decline in homes sold. Data is enlightening. A comparison of the TTM for August 2022 (199 sales) to August 2023 (104 sales) offers a clear perspective. Looking at the chart above, you’ll see that the number of closed sales has yet to bottom out. Our expectation is that this number will reach its low point by the end of the year and then slowly increase starting in 2024. Assuming interest rates stay level or decrease in 2024, it will help free up inventory (new listings) and increase buyer demand, resulting in a higher number of homes sold. It will likely push prices up as well.

In Playa Vista, based on the annual closed sales data from 2014 to 2019, a balanced market would typically see around 140 sales per year. While no market is ever perfectly balanced, this figure provides a useful benchmark to evaluate the post-pandemic market. Using this number of 140 closed sales for August’s trailing twelve months as a reference, Playa Vista’s sales are down by 29.35% from what might be expected, mainly due to high interest rates. Furthermore, sales are 48% lower than the previous year at this time, dropping from 199 sales (TTM August 2022) to 104 sales (TTM August 2023). It’s worth noting that the 199 sales for August 2022 TTM were, in part, driven by the lower interest rates of that period.

Price Resilience: Median Sales Price Stability

While closed sales witnessed a significant drop, the median sales price has remained consistent. There has been less supply because people don’t want to sell their homes with low locked-in interest rates, and less demand because the high interest rates have reduced the number of buyers in the Playa Vista market. Sales prices have remained stable, indicating supply and demand are in line with each other.

Taking another look at the Playa Vista Market Trends chart above you can see that the median sales price peaked in March of this year at $1,371,500. In August 2023 the median sales price was $1,335,000, a 2.7% drop from the peak in March. Year over Year, from August to August, the median sales price is up by 3.5%.

In the future, when rates start to decrease, we expect buyer demand will pick up faster than new inventory can come to market, pushing prices up. We could very well see another extremely competitive market for buyers when rates fall below 6%.

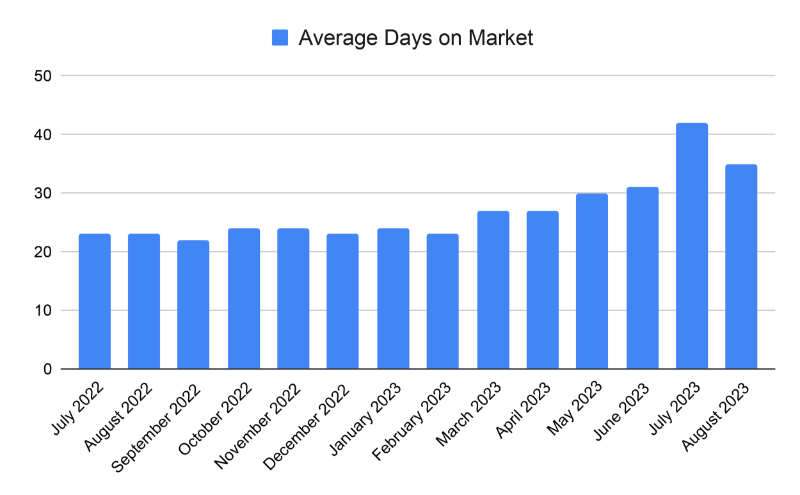

A Focus on Days on Market

During the pandemic and the low-interest-rate environment, properties in Playa Vista took an average of just 23 days to get snapped up. However, this trend is gradually changing. As of July 2023, data indicates an average of 42 days on the market, showcasing the aftereffects of the sharp spike in interest rates a year prior. Although the market’s pace slowed considerably, it has shown signs of regaining momentum, with days on the market coming down to 35 in August. Predictions based on the recent half-year data suggest the average time required to sell a Playa Vista home should decrease, stabilizing around the 30 to 35-day range.

Inventory Dynamics Amidst Rising Interest Rates

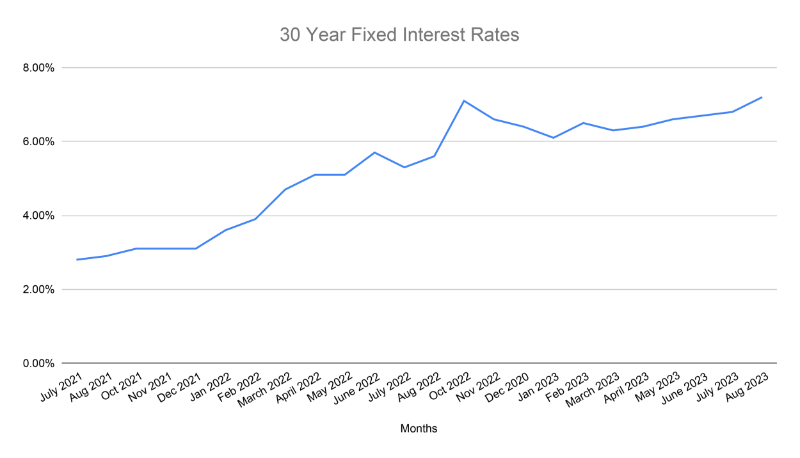

As we all know, the prominent factor affecting the Playa Vista real estate market is the surge in interest rates. Many homeowners are hesitant to sell and relocate, not wanting to swap their existing sub-3% interest rate for a new mortgage at 6% or higher. This dynamic has curtailed the number of houses available for sale. However, even with fewer homes entering the market, the slower pace provides buyers with a broader spectrum of choices and a less frenetic decision-making environment.

Playa Vista Closed Sales and New Listings – Trailing 12 Months

The Interest Rate Conundrum: Projections for 2024 and Beyond

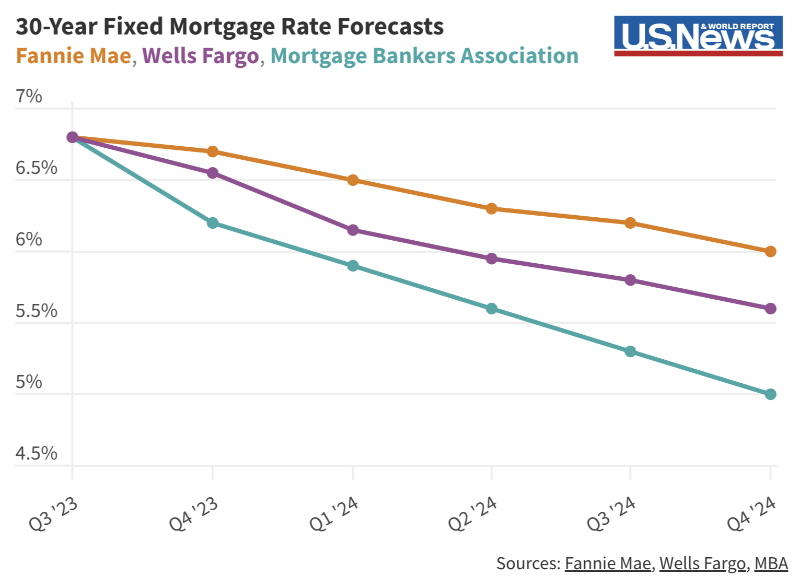

The big question on every potential homebuyer and investor’s mind revolves around the trajectory of interest rates. Industry experts, from Wells Fargo to Fannie Mae and the Mortgage Bankers Association, anticipate a plateauing, if not a decrease, in interest rates in 2024. Particularly optimistic is Morning Star, forecasting a drop to 4.5% by 2025. But what implications will falling interest rates bring? Can we expect more inventory, increased demand, and higher property prices?

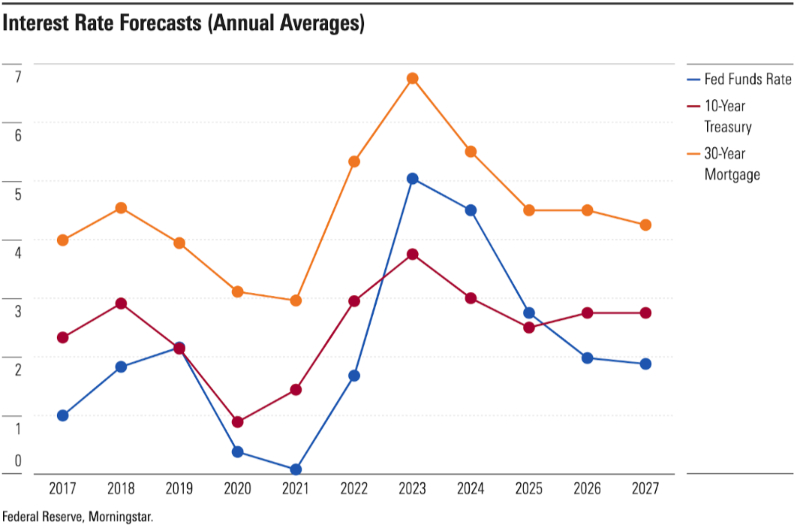

Morning Star Projections

Morning Star’s projections are the most optimistic of the bunch. Here is their outlook on the Fed Funds rate, the 10-year Treasury, and the 30-year interest rate over the next four years.

Conclusion

The Playa Vista real estate market remains resilient with sustained activity and interest. As mortgage rates continue their uncertain dance, and as the balance between demand and supply undergoes subtle shifts, potential homeowners and investors should keep an eye on trends and forecasts. By understanding the nuances of this market, one can make informed decisions for the future.