Delve into the specifics of Playa Vista’s real estate market, including sales trends, inventory levels, and the movement of home values in 2024.

Introduction: A Changing Landscape in Playa Vista

As 2024 unfolds, the real estate market in Playa Vista stands at a significant turning point. Following a year of notable shifts, homeowners and investors are looking ahead, eager to understand how these changes will shape the future of property ownership in this vibrant community. This exploration into Playa Vista’s real estate market will delve into the performance of the past year and offer a glimpse into what we can expect in the year ahead.

The Playa Vista Market in 2023: A Year in Review

To comprehend the current state of Playa Vista’s real estate market, a look back at 2023 is essential. This was a year with nearly a record low number of sales and close to flat prices both heavily influenced by the Fed’s response to higher inflation.

Playa Vista Market Trends – Trailing Twelve Months (ttm)

Playa Vista Closed Sales in 2023 – Nearly a New All-time Low

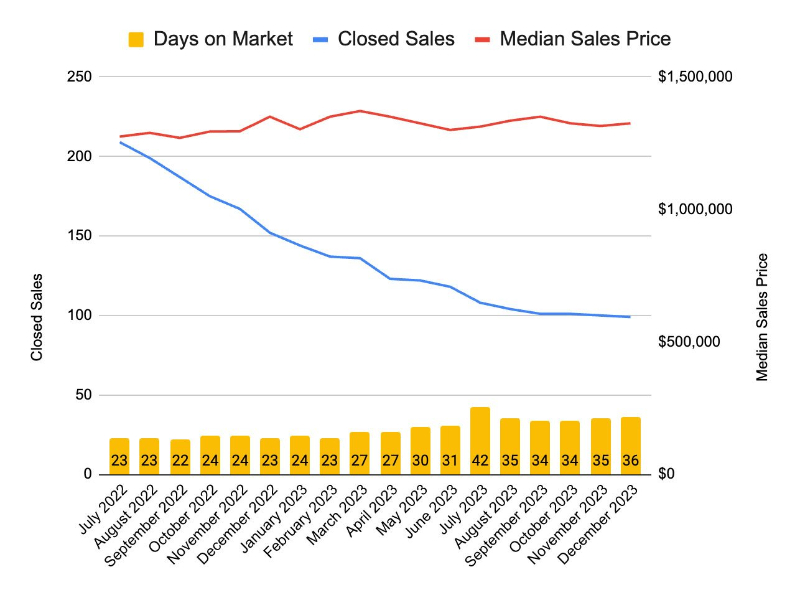

In 2023, the Playa Vista real estate market witnessed a significant shift, with the number of closed sales dropping dramatically to 99. This represents a 62% decrease from the peak of 263 sales in 2021, a period characterized by pandemic-induced low mortgage rates. Compared to the last “normal” market in 2019, this also marked a 32% decrease.

To find a year with fewer sales in Playa Vista, we have to look back to 2009, which recorded 98 sales. It’s important to note that during this time, much of the neighborhood’s construction was still incomplete. Developments such as the second half of ICON (also known as Cielo), Primera Terra, Seabluff, Encore, and all of Phase II – including Skylar, Camden, Woodson, Asher, Everly, Marlowe, The Collection, Mason, Cleo, and Jewel – were yet to be built.

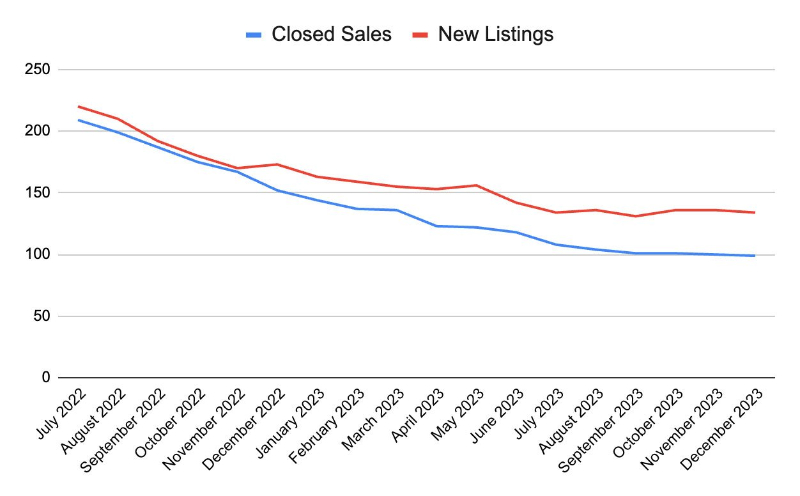

Despite these trends, there is positive news. As indicated by the chart, the number of closed sales appears to be stabilizing at around 100 annually. Looking ahead to 2024, there is an expectation of increased inventory and transaction activity in the neighborhood. The California Association of Realtors is forecasting a 22% rise in closed sales for the state in 2024.

Home Values and New Inventory

The recent shift in the real estate market can largely be attributed to the rise in interest rates, which significantly cooled demand. This led to fewer homes coming to market, as many homeowners were reluctant to exchange their sub-3% interest rates for new mortgages at over 6%. They chose not to list their properties unless it was necessary. Consequently, the reduction in available inventory, coupled with diminished demand due to higher interest rates, resulted in stable home values. This is a clear demonstration of the economic law of supply and demand.

In 2022, even as mortgage rates climbed above 8%, home values remained resilient, with just a 1.85% reduction when comparing 2022 to 2023. In contrast, the median sales price for all of California declined by 1.5%.

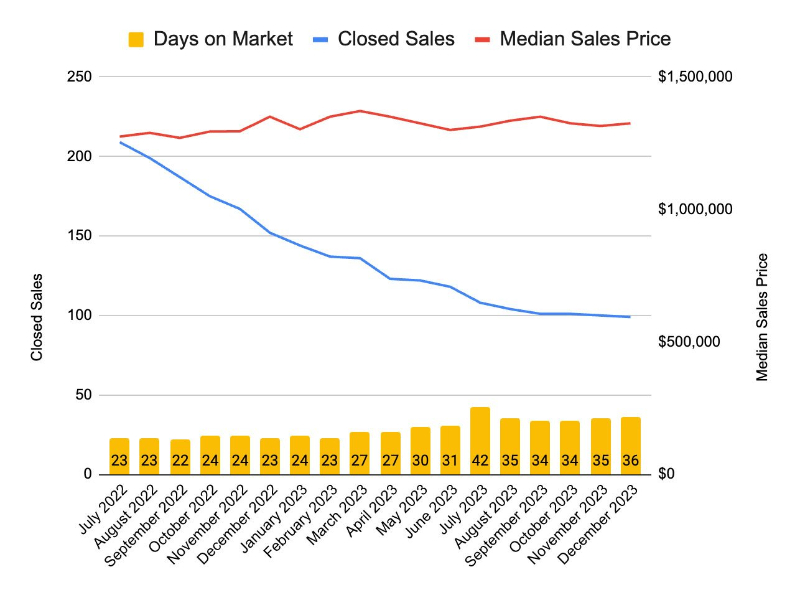

Another key factor in this shift was the level of inventory. In September 2023, the trailing 12-month inventory reached its lowest point at 131 properties, indicating that it was bottoming out, similar to closed sales. In the 4th quarter of 2023, there was a trend of new inventory consistently staying above this low. This suggests a slow but steady increase in properties entering the market as we move into 2024.

Comparing Closed Sales and New Inventory in Playa Vista

California Association of Realtors 2024 Forecast

Forecasting Mortgage Rates in 2024

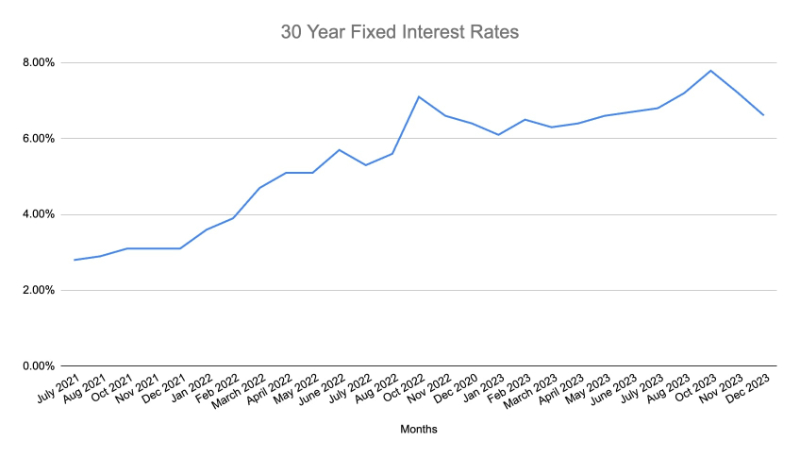

The big question for 2024 is the trajectory of mortgage rates. Predictions suggest a gradual decrease, which could rejuvenate the real estate market by encouraging both selling and buying activities.

Here are a few experts commenting on mortgage rates for 2024:

- National Association of Realtors chief economist Lawrence Yun. “Mortgage rates look to head towards 7% in a few months and into the 6% range by the spring of 2024.”

- RSM U.S. real estate senior analyst Crystal Sunbury. “Assuming no significant economic shocks, mortgage rates are likely to continue slowly easing over the next few months, to reach a 6% to 6.5% range by spring of 2024.”

- Mortgage Bankers Association (MBA). MBA’s baseline forecast is for mortgage rates to end 2024 at 6.1% and reach 5.5% at the end of 2025 as Treasury rates decline and the spread narrows.

- Bank of America head of retail lending Matt Vernon. “The Fed’s likely decision to cut rates in 2024 would be a key factor that could breathe new life into the housing market. However, it’s important to note that significant drops in mortgage rates might not happen in the early months of 2024. If any reductions occur, they are likely to be gradual, possibly beginning in the latter part of the year.”

- Palisades Group chief investment officer and co-founder Jack Macdowell. “Our best guess is that mortgage rates will remain in the 7% to 7.25% range throughout Q1 2024.”

- Fannie Mae Housing Forecast. The 30-year fixed rate mortgage will average 7% in Q1 2024 and slowly decline over the year, landing at a Q4 average of 6.5%.

Housing Market Predictions for Playa Vista

Interest rates, which have now stabilized and are expected to trend downwards, raise the question: do they still matter as much? The elimination of uncertainty about interest rates, which often freezes markets, should aid in revitalizing the real estate market. While rates remain important, the clarity on their trajectory is likely to encourage market movement.

Many buyers and sellers have been delaying their plans and life decisions due to fluctuating interest rates. However, this situation cannot persist indefinitely. Our forecast for 2024 is that these paused plans will resume, leading to an increase in available inventory for sale and a corresponding rise in demand.

In 2023, both closed sales and new inventory likely reached their lowest points, indicating that more homes are expected to sell this year. However, we don’t anticipate reaching the levels seen in 2019.

Regarding home values, the determining factor will be whether inventory outpaces demand or vice versa. The California Association of Realtors forecasts a 6.2 percent increase in the median home price for single-family homes in California this year.

Early in the year, the supply, demand, and absorption rate of new listings coming to market will provide valuable insights, giving us a clearer indication of the market’s direction in 2024.

Conclusion: A Strategic Approach to Playa Vista’s Real Estate

As we move through 2024, Playa Vista’s real estate market presents a blend of challenges and opportunities. For homeowners and investors, a strategic approach, informed by an understanding of the latest market trends, will be key to navigating this dynamic landscape. With a potentially more active market on the horizon, staying adaptable and well-informed will be crucial for making the most of the opportunities in Playa Vista’s evolving real estate story.